In today’s world, cell phones have become an essential part of our lives. We use them to stay connected with friends and family, to stay organized, and even for work. However, the more we rely on them, the more vulnerable they become to accidents and damage. This is where cell phone insurance comes in. But is it really worth it? Does it provide enough coverage for the cost? In this blog post, we will explore both sides of the argument and help you make an informed decision on whether or not cell phone insurance is a smart choice for you.

Understanding Cell Phone Insurance: What It Covers and What It Doesn’t

Cell phone insurance is a type of coverage that protects your device from damage, loss, or theft. While it may seem like a smart investment, it’s important to understand what it covers and what it doesn’t. Most policies cover accidental damage, such as a cracked screen or water damage, but they may not cover loss or theft. Additionally, some policies have deductibles and limits on the number of claims you can make. It’s important to read the fine print and understand the terms of your policy before signing up. Cell phone insurance can provide peace of mind, but it’s not always necessary. If you have a newer device or are accident-prone, it may be worth considering. However, if you have an older device or can afford to replace it out-of-pocket, cell phone insurance may not be worth the cost.

The Pros and Cons of Investing in Cell Phone Insurance

Pros and Cons of Investing in Cell Phone Insurance

Cell phone insurance can be a lifesaver if you accidentally drop your phone or it gets stolen. However, it’s important to weigh the pros and cons before investing in a plan.

One advantage of cell phone insurance is that it can provide peace of mind. You won’t have to worry about the cost of repairing or replacing your phone if something happens to it. Additionally, some plans offer additional benefits such as extended warranties or coverage for water damage.

On the other hand, cell phone insurance can be expensive. Depending on the plan, you may have to pay a monthly fee in addition to a deductible if you need to file a claim. In some cases, the cost of repairs or replacement may not be worth the price of the insurance.

Another factor to consider is the coverage offered by your plan. Some plans may not cover certain types of damage or loss, such as theft or accidental damage. It’s important to read the fine print and understand exactly what is covered before signing up for a plan.

Overall, investing in cell phone insurance can be a smart choice for some individuals, but not necessarily for everyone. It’s important to weigh the costs and benefits and make an informed decision based on your individual needs and circumstances.

Is Cell Phone Insurance Worth the Cost? A Comprehensive Analysis

Is cell phone insurance worth the cost? This question doesn’t have a straightforward answer. It depends on several factors, such as how likely you are to damage or lose your device and whether or not you can afford to replace it if something happens. Another important consideration is the cost of the insurance plan itself. Some plans may only cover certain types of damage, while others come with hefty deductibles that consumers must pay before they can make a claim.

If you’re someone who tends to be clumsy or accident-prone, then investing in cell phone insurance might give you peace of mind. However, for those who take good care of their devices and have never experienced any major issues, cell phone insurance might just be an unnecessary expense.

Ultimately, it’s up to each individual consumer to decide whether or not cell phone insurance is worth it based on their specific needs and budget.

How to Decide Whether or Not to Get Cell Phone Insurance

When it comes to deciding whether or not to invest in cell phone insurance, there are a few key factors to consider. First and foremost, evaluate how likely you are to damage or lose your phone. If you tend to be clumsy or work in an environment where your phone is at risk of being damaged, then insurance might be worth the investment for peace of mind.

Additionally, examine the cost of your phone and the cost of potential repairs or replacements without insurance. If it would be financially burdensome for you to replace your phone out-of-pocket, then having coverage may make sense.

It’s important to note that not all cell phone insurance plans are created equal, so do some research before selecting a plan. Look into deductibles, coverage limitations, and exclusions (such as lost phones). Also consider if any extra perks come with the plan such as tech support services.

Ultimately, the decision on whether or not to get cell phone insurance should weigh both financial considerations and personal habits/behaviors when it comes to taking care of technology devices.

Alternatives to Cell Phone Insurance: Exploring Your Options

When it comes to protecting your cell phone, insurance isn’t the only option. One alternative to consider is a warranty or extended warranty. Many cell phone manufacturers offer warranties that cover defects and malfunctions for a certain period of time. An extended warranty can also be purchased for additional coverage. However, it’s important to note that warranties typically don’t cover accidental damage or loss.

Another option is to self-insure by setting aside money each month for potential repairs or replacements. This can be a good choice for those who are careful with their phones and have a history of not needing frequent repairs.

Finally, some credit cards offer cell phone protection as a perk. If you already have a credit card with this benefit, it may be worth considering as an alternative to traditional insurance. However, it’s important to read the fine print and understand the limitations and requirements of the coverage.

Ultimately, the best option will depend on your individual needs and usage habits. It’s important to weigh the costs and benefits of each option before making a decision on how to protect your valuable device.

Common Misconceptions About Cell Phone Insurance Debunked

There are many misconceptions about cell phone insurance that can make it difficult to determine whether or not it’s worth investing in. One of the most common myths is that if you have a warranty, you don’t need insurance. The truth is, warranties only cover manufacturing defects and not accidental damage, loss or theft.

Another misconception is that carriers always offer the best deals on cell phone insurance plans. However, third-party companies may actually provide more affordable coverage with better terms and conditions.

It’s also important to note that some people assume their homeowners or renters’ insurance policy already covers smartphone damage or loss but this isn’t always true. You should review your policy carefully before making any assumptions about what’s covered.

Finally, many believe they’ll receive a brand new replacement if their device is damaged beyond repair. But often times it will be refurbished which might raise another concern for buyers as being unsure of the quality of these replacements.

It’s important to understand these misconceptions in order to make an informed decision on whether or not cell phone insurance is right for you.

The Hidden Costs of Cell Phone Insurance You Need to Know About

Understanding the Fine Print: What You Need to Know Before Signing Up for Cell Phone Insurance

Before signing up for cell phone insurance, it’s critical to read and understand the fine print. Many insurances come with restrictions, exclusions, and limitations that can nullify your coverage when you need it most. For example, some policies may not cover water damage or screen cracks while others won’t offer protection against loss or theft. Furthermore, even if you get a policy that covers these situations, there might be deductibles or caps on how much reimbursement you can receive. Be sure to review each plan carefully so you’re aware of what’s covered and what isn’t before agreeING to sign up for any insurance plan.

Alternatives to Cell Phone Insurance: Tips for Protecting Your Device Without Breaking the Bank

There are alternatives to cell phone insurance that can help you protect your device without breaking the bank. Protective cases and screen protectors can go a long way in preventing damage from drops, scratches, and other accidents. Additionally, some credit cards offer free or discounted phone protection plans as one of their benefits, so it’s worth checking with your provider to see if this is an option for you. If you’re someone who tends to lose or misplace their device frequently, consider using a tracking app like Find My iPhone or Google Find My Device to locate it quickly in case it goes missing. With these tips in mind, you may find that alternative options provide sufficient coverage for your needs without the added cost of cell phone insurance.

Tips for Choosing the Right Cell Phone Insurance Plan for You

Assessing Your Risk: Is Cell Phone Insurance Necessary for You?

Before deciding on a cell phone insurance plan, it’s important to assess your risk. If you are prone to dropping or losing your phone, then cell phone insurance may be worth the investment. Additionally, if you have an expensive device that would be costly to replace out-of-pocket, then insurance could provide peace of mind.

On the other hand, if you rarely lose or damage your phone and can comfortably afford a replacement device if needed, then skipping insurance may be the better option for you. It’s also important to consider any deductibles and monthly premiums associated with the plan before making a decision.

Ultimately, whether or not cell phone insurance is necessary for you depends on your individual circumstances and level of risk tolerance.

Comparing Coverage: What to Look for in a Cell Phone Insurance Plan

When comparing cell phone insurance plans, make sure to look for coverage that meets your specific needs. Key factors to consider include the cost of monthly premiums, deductibles, and coverage limits. Additionally, check if the plan covers accidental damage like drops or spills or loss/theft of your device (relevant key phrase). Some plans may only provide coverage for certain types of damage or require you to purchase additional protection for loss/theft scenarios. It’s also important to read the fine print and understand any exclusions or restrictions on coverage so you know what situations are not covered by your plan (relevant key phrase). Comparing different options can help you find a plan with features that fit both your budget and protection requirements.

Cost vs. Benefit: Evaluating the Value of Cell Phone Insurance

When choosing a cell phone insurance plan, it’s important to evaluate the cost versus the benefits. Consider how much you paid for your phone and how likely you are to need repairs or replacements. Look at the deductibles, premiums, and coverage limits of each plan to determine which one offers the most value based on your needs. Keep in mind that some plans may offer additional perks such as tech support or device upgrades. Remember that cell phone insurance can provide peace of mind, but it may not always be necessary depending on your individual circumstances and risk tolerance.

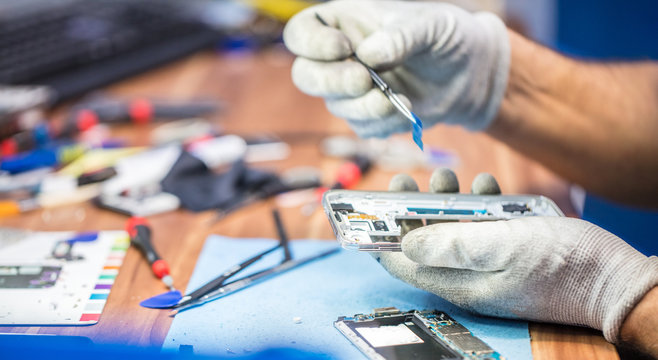

Alternative Options: Considering Self-Insurance and Third-Party Repairs

If you’re wary of investing in a cell phone insurance plan, there are alternative options worth considering. One option is self-insuring by setting aside a small amount of money each month for potential repairs or replacements. Another option is seeking out reputable third-party repair services. However, it’s important to note that self-insuring may not cover all damages, and third-party repairs could potentially void your warranty or cause further damage if done improperly. It’s crucial to do your research before pursuing these alternatives and weigh the risks versus benefits carefully to make an informed decision about how best to protect your device.

When to Skip Cell Phone Insurance: Factors to Consider

Factors to Consider When Deciding Whether or Not to Get Cell Phone Insurance

While cell phone insurance can provide peace of mind, it may not always be the best choice for everyone. Before deciding whether or not to invest in a plan, there are several factors to consider.

Firstly, assess the likelihood of damage or loss. If you tend to be clumsy or work in an environment where your phone is at risk, insurance may be a wise investment. However, if you are generally careful with your device and have never lost or damaged a phone before, it may not be necessary.

Secondly, evaluate the cost of the insurance plan. Compare the monthly premium with the cost of repairing or replacing your phone without insurance. If the cost of repairs or replacement is significantly lower than the monthly premium, it may not be worth it.

Lastly, consider any existing warranties or credit card benefits that may cover phone damage or loss. Some credit cards offer protection for purchases made with their card and some phones come with manufacturer warranties that cover certain types of damage.

By taking these factors into account, you can make an informed decision about whether or not cell phone insurance is right for you.

In conclusion, deciding whether or not to invest in cell phone insurance can be a tricky decision. It’s important to weigh the pros and cons, understand what is covered and what isn’t, and consider alternative options. While it may provide peace of mind for some, it may not be worth the cost for others. Ultimately, the decision is up to you and your individual circumstances.

If you found this article helpful, be sure to check out our other content on technology and personal finance. We provide expert insights and advice on a variety of topics to help you make informed decisions about your finances and technology needs. Thanks for reading!